Do This One Thing to Avoid Paying Interest on Your Credit Card

If you’re paying interest fees each month (on your credit card), that basically means that 1) you’re not paying your balance off in full and 2) you’re most likely misreading your statement.

I’ve been stuck in this scenario more than I’d like to admit, however, once I took the time to read my statement properly, I was able to save myself more money each month.

When looking at the “summary of account activity” (basically the first breakdown you’ll see on your statement), note the previous balance. This equates to what you’ve paid (-) and what you purchased (+), prior to showing the new balance. Everything else is pretty straight forward like your credit limit (the total amount you were approved for) and your available credit (the current amount you are able to spend).

What most people do not realize is that the “new balance” does not necessarily mean you are obligated to pay that whole amount right away. The goal is to always make sure to pay in full to avoid interest fees, so the most important place to look at is the “statement closing date”, which is the end date of that statement period. By paying attention to this, you can save yourself from paying extra each month.

If you need to make any other additional charges on the card, but do not have the budget to pay more than what your current statement balance is, then wait until after the closing date.

Don’t assume that credit cards function in a standard beginning of the month to end of month deal. Every statement closing date is different and knowing when it closes will help you organize and budget your paychecks. This tip is to help you avoid the interest fees and also make you further aware of how much you are really swiping versus what you can afford to pay in full on the due date.

The tip? Once you confirm when your closing date is, wait for the following day after the closing date to continue swiping on the card (as/if needed).

Example: The closing date is the 8th and it’s the 6th, and your current balance is $200. Say you swiped $300 on the 7th. Now your current balance is $500 and your statement balance is now $500, which is what you have to pay in full on the due date (if you want to avoid paying interest).

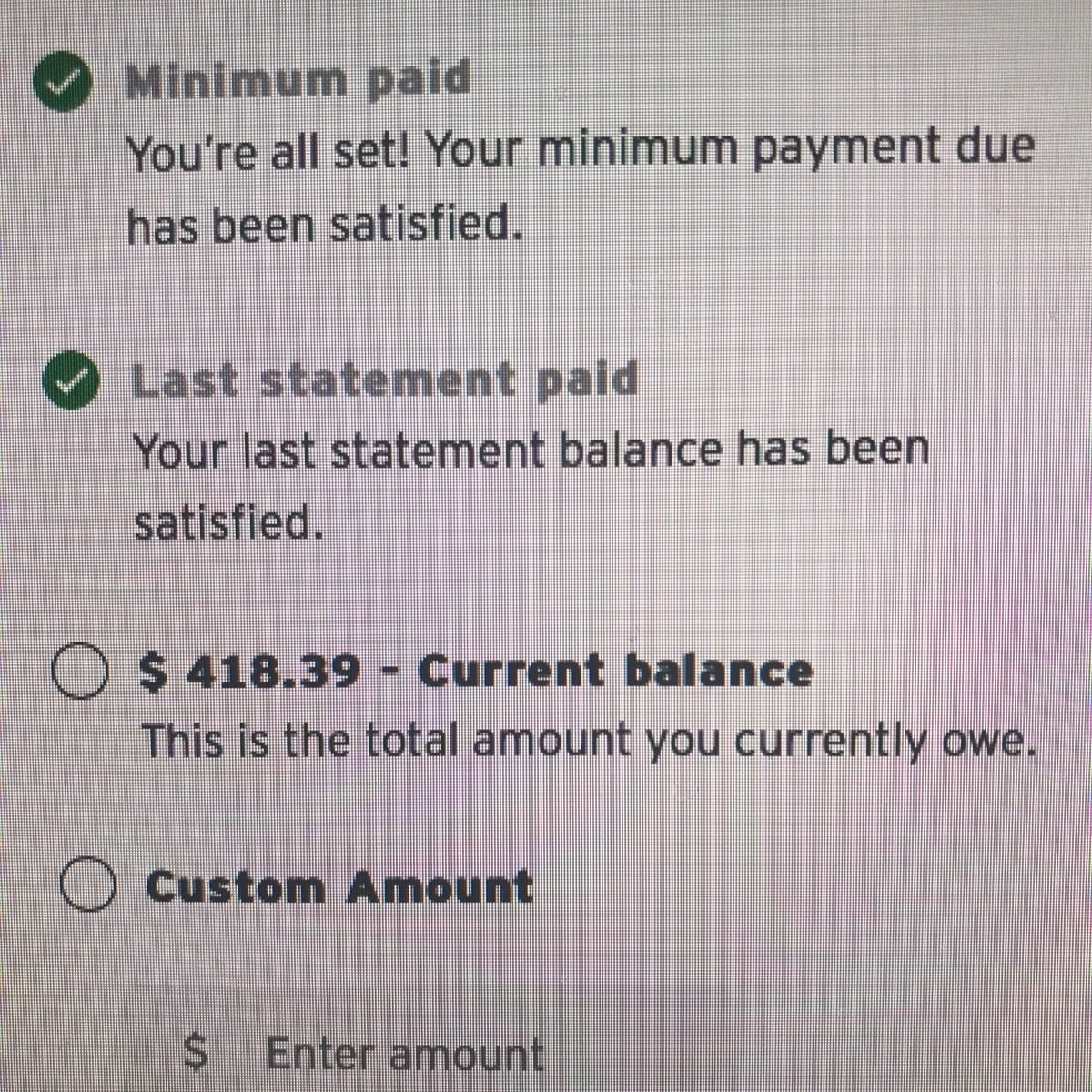

However, if you swipe that $300 on the 9th, your current balance will equate to $500 --BUT your statement balance will only be $200. Now you only have to worry about paying the $200 off since you swiped the $300 AFTER the closing date.

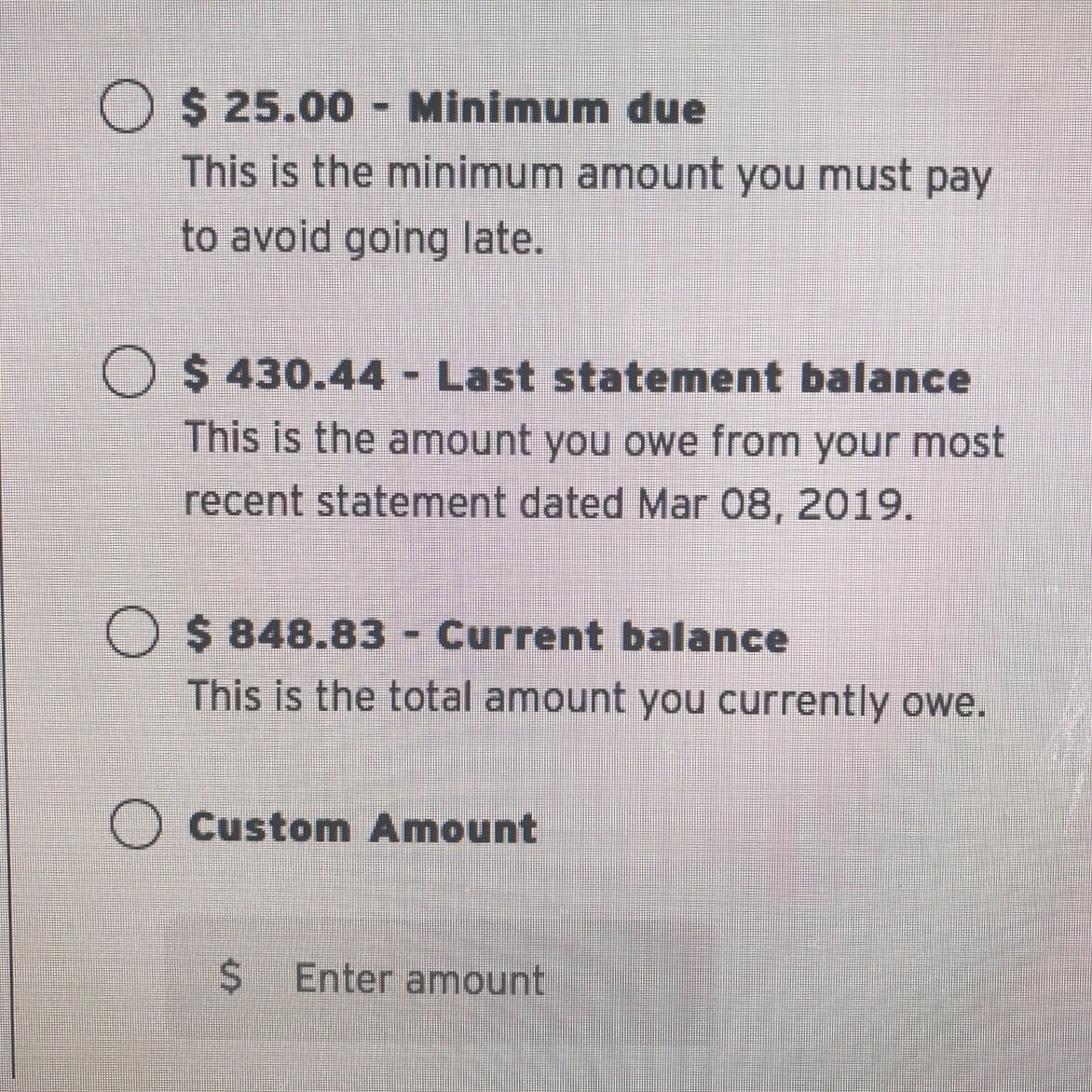

Essentially, all charges made after the closing date are applied to next month’s statement and to avoid interest, you just have to pay the statement balance in full for that month by the due date. So, you’ll have an extra 30 days to pay off those additional charges in full now (without interest). Just make sure to always select “statement balance” in your payment options.

Originally written by Sho with editing by Lisa Linh.

About Shoshanna: Sho is a DIY financial guru, known for her money tips and advise on credit card debt and is an expert on budgeting. She's helped several people raise their credit score, pay off their credit card debt, and also assists those in their taxes. She is currently focused on her medical career, but offers financial tips on ByLisaLinh.com during her free time.